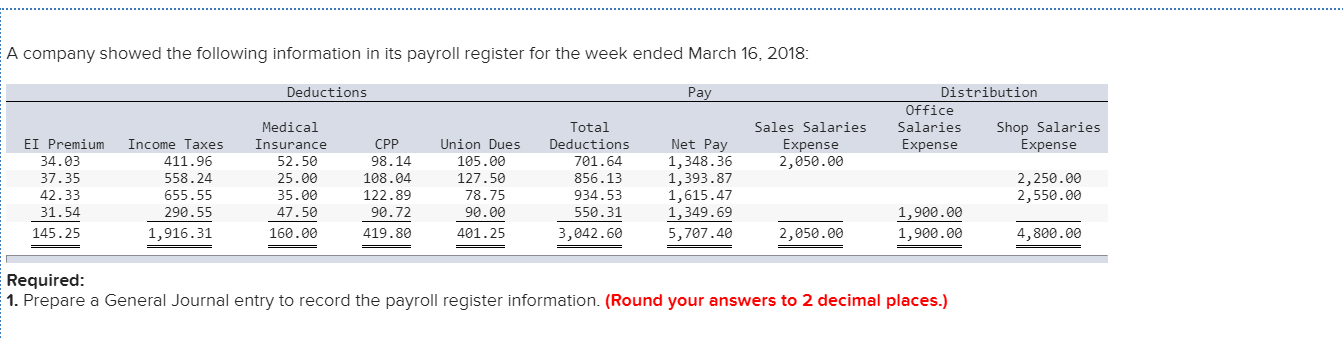

We manage the headcount payrolling and compliance for all of your freelance employees. Federal income taxes 4100.

You may also need to pull reports for deductions.

. Ad The Largest Global Employer Of Record In 185 Countries And All 50 United States. Streamline Payroll Processing In 160 Countries for EOR Contractors and Payroll Workers. The employer is required by law to withhold payroll taxes from an employees gross pay prior to issuing a paycheck to comply with government regulations.

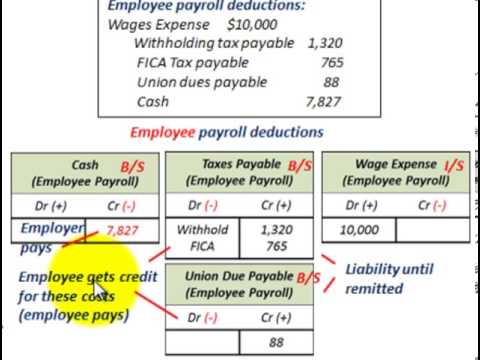

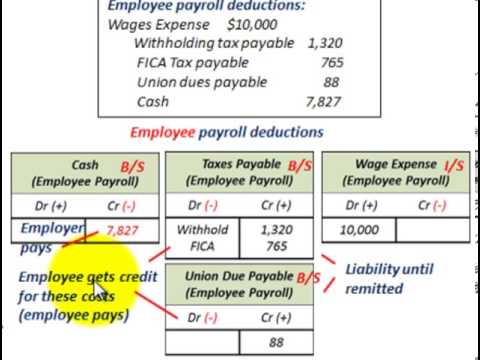

The primary payroll journal entry is for the initial recordation of a payroll. Personal information name address etc Employment information offer letters evaluations etc Exemption status and rate of pay. The company withheld the following amounts from the employees pay.

1 Multiple Choice Employee receivables. Certified HR Services For Building Global Teams. Free Unbiased Reviews Top Picks.

An example might be an employer loan to an employee a loan agreement should be signed which the employee is paying back with payroll. Current liabilities Wages payable. For each employee payroll records commonly consist of.

Ad Expand Your Workforce With Our Award Winning Global EOR Services. The employer should record deductions from employee pay as. The forms will tell you how much of an employees wages you should deduct each pay period.

Shows a breakdown of the taxes you withheld from employee wages plus taxes you owe as an employer. No plan document needs to be adopted under this arrangement. The amount of federal income taxes withheld from an employees paycheck is determined by.

Ad Compare This Years Top 5 Free Payroll Software. Streamline Payroll Processing In 160 Countries for EOR Contractors and Payroll Workers. There is no Check to write.

Ad As an Employer of Record PayReel eliminates the corporate red tape of hiring new workers. The Payroll Deduction would be linked not to Liability. As A PEO We Can Manage Hiring Visas Payroll Social Contribution Expenses Compliance.

Link it back into the expense account you already paid out of internal reimbursement. The key types of payroll journal entries are noted below. The employer should record deductions from employee pay as.

Payroll tax report. As a result payroll deductions are recorded as current liabilities. The employer is obligated to submit the collected funds to the appropriate body.

We Handle Payroll Taxes Compliance Benefits Unemployment and More. The Payroll Deduction IRA is probably the simplest retirement arrangement that a business can have. The employer should record deductions from employee pay as.

Ad Expand Your Workforce With Our Award Winning Global EOR Services. Calculations will also depend on your state and sometimes your city or county. This entry records the.

These can be made at any time. Ad Onboard Staff Within 24hrs From 290 pm. You should get the information from your employer payroll department if you really need to know the correct numbers or amount that should be deducted from your gross.

Assume a company had a payroll of 35000 for the month of April.

Solved 92 The Employer Should Record Payroll Deductions As Chegg Com

General Entry For 1 Record Payroll Deductions For Chegg Com

Solved The Employer Should Record Deductions From Employee Chegg Com

Current Liabilities Accounting Payroll Deductions Employee Vs Employer Payables Expense Youtube

0 Comments